Financial News

Face to Face, Not in Your Face

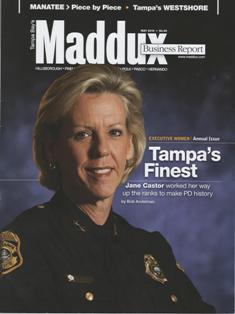

May 2010 issue of Tampa Bay's Maddux Business Report

Tampa Asset Management is very proud to have been featured in the May 2010 issue of Tampa Bay's Maddux Business Report, in an article entitled "Face to Face, Not in Your Face". The article talks about the recent shift of high net worth investors away from big brokerage firms and toward Registered Investment Advisors (RIAs) like Tampa Asset Management. Below is the article in its entirety: Tampa Asset Management is very proud to have been featured in the May 2010 issue of Tampa Bay's Maddux Business Report, in an article entitled "Face to Face, Not in Your Face". The article talks about the recent shift of high net worth investors away from big brokerage firms and toward Registered Investment Advisors (RIAs) like Tampa Asset Management. Below is the article in its entirety:

FACE TO FACE, NOT IN YOUR FACE

Late last year, the Spectrem Group, a Chicago-based organization that tracks the affluent and retirement markets, reported that "for the first time ever, mass affluent investors have rejected full-service brokers as their sole top choice for primary advisor."

Not that this happened overnight. It's been an event in the making over the last decade. Some of the reasons? Pushing folks into investments the majors had vested interests in; excessive commissions; less than original analysis. Many of these affluent investors are turning to an alternative resource like a Registered Investment Advisor (RIA).

A local example of an RIA is Bob Garey of Tampa Asset Management. He offers investment advice and charges a fee. (RIAs have the choice of charging a flat fee for their services or as a percentage of an investor's portfolio size, which averages about one percent across the board.) Garey doesn't sell or promote products or receive commissions on trades. When he and his clients have agreed upon an investment strategy, he implements their wishes through a securities firm such as Charles Schwab. That firm then becomes a custodian for the clients. It holds their assets and affects whatever transactions Garey and the client decide upon.

RIAs must register with the Securities and Exchange Commission and more often than not work with high net worth individuals or groups of clients with big asset portfolios.

Formerly with Wachovia Securities and Smith Barney, Garey says: "There hasn't been a big migration yet, but people are showing dissatisfaction with the big-named firms. Our main growth is coming from referrals. We are seeing customers who want a local advisor, face-to-face consulting and a long-term relationship."

|